Global Driving Reimbursement Report

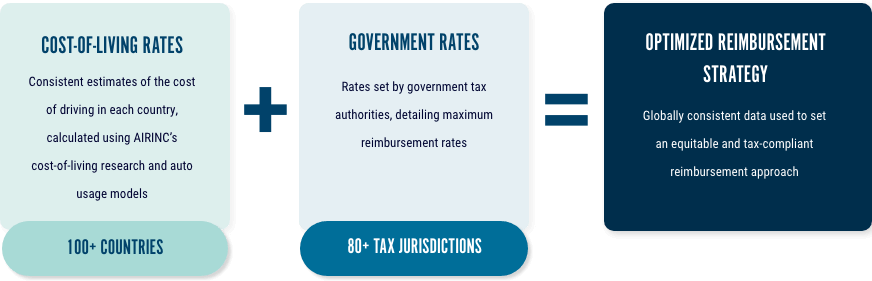

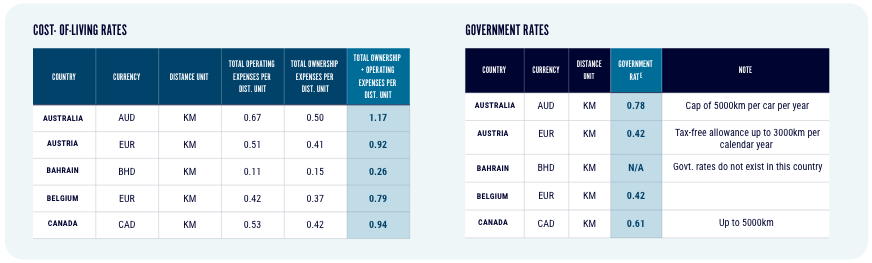

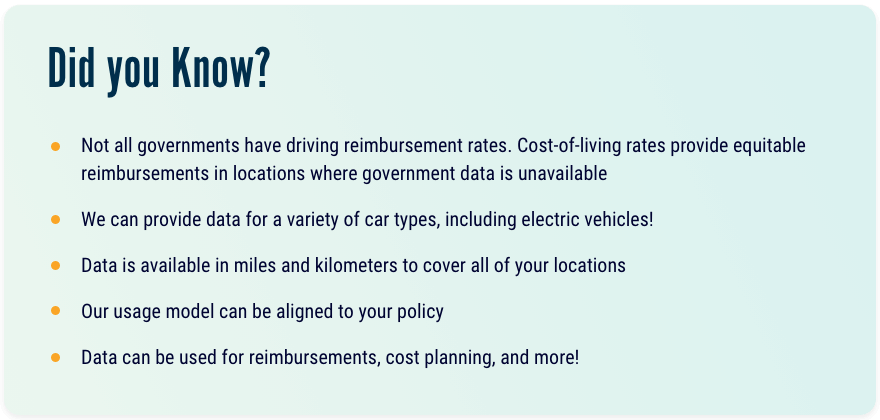

Companies need data to fairly reimburse employees’ company car use and personal auto-use for business purposes. AIRINC’s Global Driving Reimbursement Report provides insight into government rates set by tax authorities and cost-of-living rates which use the same calculation across countries. The combination provides companies insight into how to reimburse personal and company auto-use consistently across the globe.

Auto Reimbursement Rates

Benefits of The Global Driving Reimbursement Report

Data to support global driving reimbursement policies, helping to ensure:

Consistency across multiple locations, eliminating confusion and ambiguity

Cost-Optimization – cost-of-living reimbursement rates help the company to avoid over- or under-paying in different regions

Efficiency by streamlining the reimbursement process and reducing the administrative burden on HR and finance teams

Employee Satisfaction by providing clear guidelines and fair compensation

Government Reports

Combine data from tax authorities in over 80 countries. We capture country-specific practices such as reimbursement

by engine size, auto type, or province/region.

Data is updated annually.

Cost-of-living Reports

Use AIRINC automative cost research & usage model for over 100 countries. Data is available for compact cars, mid-sized sedans, premium sedans, luxury sedans, SUVs, a composite of automobiles, and electric vehicles.

Data is updated semi-annually.